Planning and saving for the future is crucial to having enough money in retirement. The State Pension barely funds a basic lifestyle, so it’s vital that you make the most of your workplace pension.

How does it work?

You and your employer pay into your Pension Account, which is then invested. Most people can get income tax relief on up to £60,000 of contributions a year and, hopefully, benefit from their investments going up (but they can go down too). You can find out more about investing here. Your Personal Account will stay invested when you leave your employer, but you won’t be able to pay in to it. You can also transfer to another pension arrangement.

Who looks after your pension?

Whilst you might know your pension under a specific name, it is the SEI Master Trust who looks after and provides your pension. The SEI Master Trust is authorised and supervised by The Pensions Regulator (TPR). Each employer has its own section, with £4 billion of members' money overall.

The Trustee keeps your money safe

Your Pension Account is held by the Trustee, separate from your employer, so it would be safe if your employer went bust.

Getting more out of your contributions

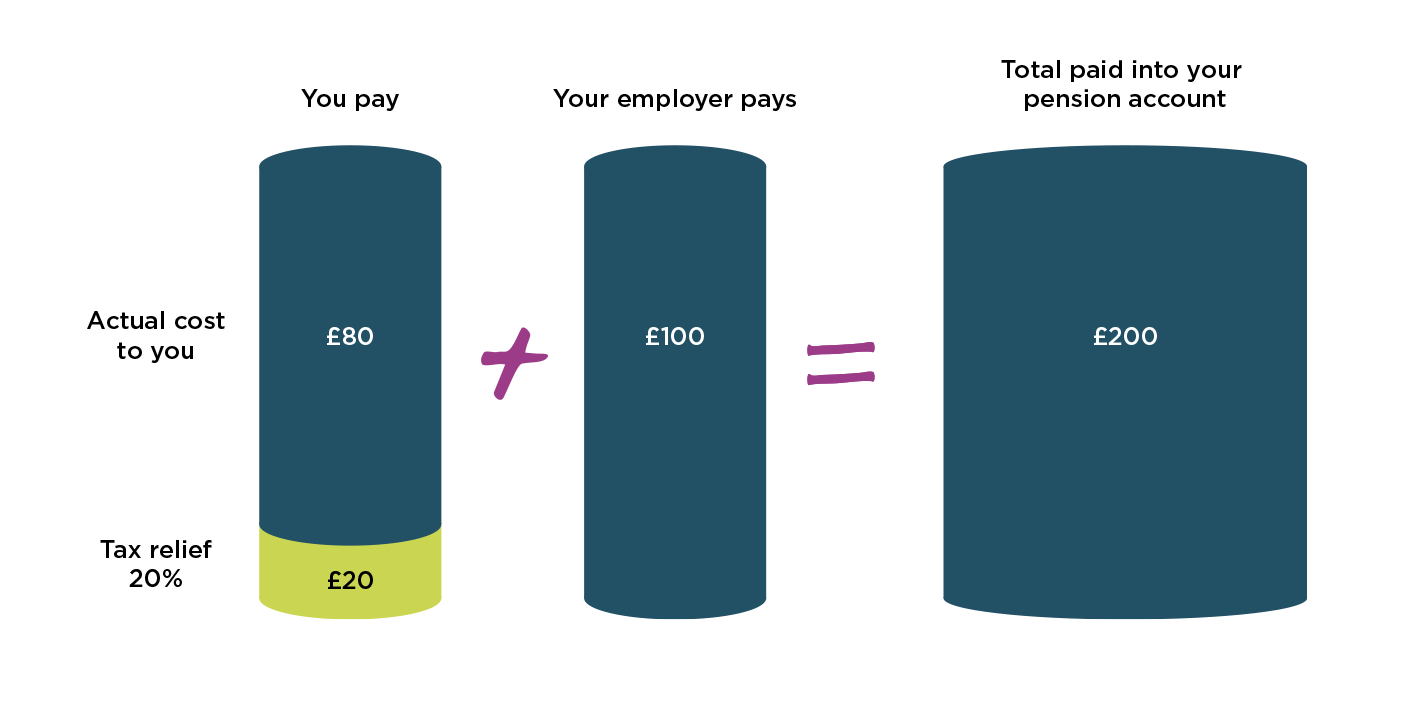

A basic rate taxpayer will benefit from 20% tax relief to top up their contributions. You may also save on National Insurance contributions if you're in a salary sacrifice scheme.

Your employer will also pay in to your Personal Account (your member booklet will tell you how much they pay).

How much should you save?

The State Pension is only about £11,500 a year. Work out how much you might need on top of that by using our Retirement Planner and comparing that to the Retirement Living Standards. This will show you if your ideas for retirement are realistic and if you’re on track.

We have tools available so you can see how this would help and to start getting on track for the retirement you want.

The ‘payments’ calculator can help you work out how much extra money you save, when combined with your employer’s payments and any tax savings. The retirement calculator helps you to work out what sort of income you might want when you stop work, or start to take things easy.

Having all your pensions in one place can make it easier to keep track, but isn’t right for everyone as charges and benefits/guarantees can be different in other arrangements. You should consider taking financial advice first - go to MoneyHelper for guidance and to find an adviser.

Your Pension Account would have longer to grow with extra contributions and, hopefully, investment growth. Or you could delay your State Pension, which will increase the later you take it (more information).

When life gets in the way

Unanticipated life events can affect your ability to save. Visit our Divorce and If you die pages for more information. MoneyHelper also has information about retiring due to Ill health.