Tax affects your pension in different ways, at different stages to and through your retirement. It’s important to keep an eye on what the latest tax laws are, and how they affect you specifically.

While you’re saving into your pension

You have an annual allowance of up to £60,000 of contributions a year. Paying in more than this could result in tax charges.

Key information

- If you didn’t use the previous year’s full annual allowance, you can use what’s left over of that allowance in addition to your current year’s allowance. This is called ‘carry forward’.

- Higher earners may be subject to a taper i.e. reduced annual allowance.

- The limit applies to all your pensions, it is not for each of them and includes payments made by you, your employer or anyone else who pays on your behalf.

- You can save up to 100% of your taxable earnings into a pension, subject to HMRC limits.

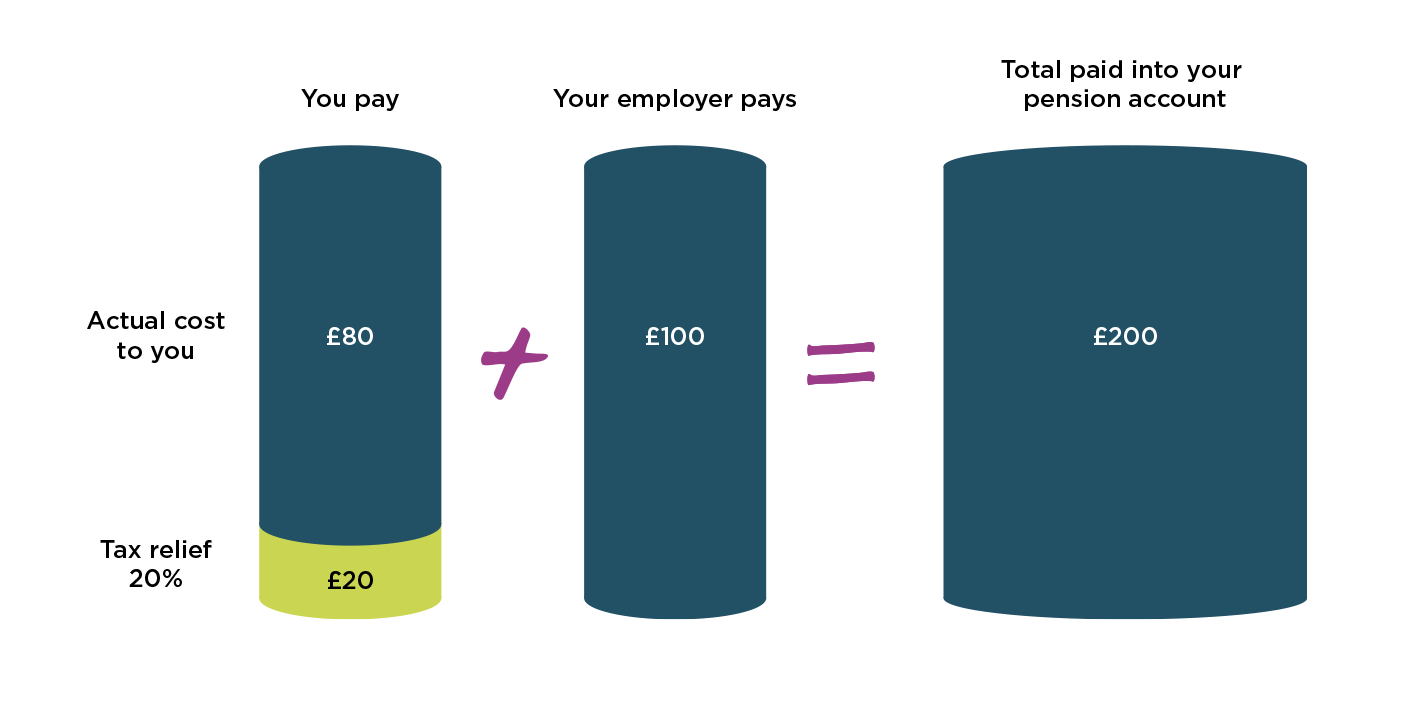

You can see from this illustration how the tax relief helps towards your retirement goals.

When taking your pension savings as an income

Like any income, depending on how much money you receive, you could be subject to tax. To find out more about how tax affects you when using your pension savings as an income, click here.

If you receive benefits, you should check if your pension income will affect how you pay tax and if it affects whether you qualify benefits.

Important things to consider

Tax treatment

Pension tax laws change fairly often. Tax references in this site are correct as at 6 April 2025.

The Trust is registered with HMRC, meaning:

- Investment income is mostly tax-free

- Some lump sums can be paid tax-free - visit the Government website for the latest information

Regulated and unbiased information

You can also find more information about pensions and tax on the MoneyHelper website.