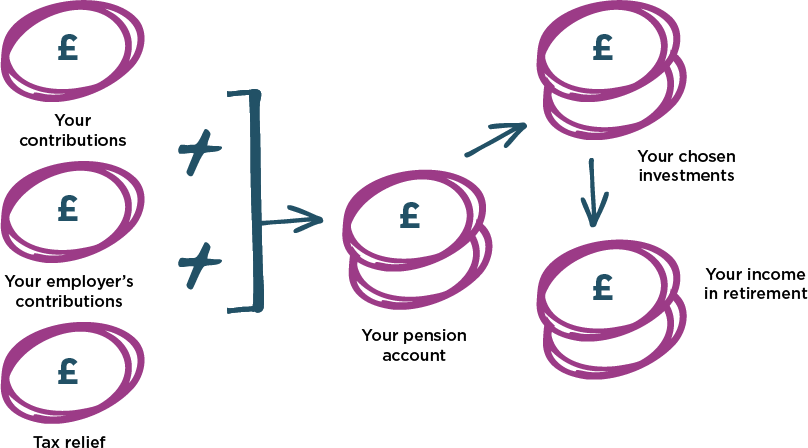

Your Pension Account is invested, to give it the chance to grow.

There is a carefully chosen default investment option, or other options for those that want more choice.

Your investment needs can change with time, so it’s always a good idea to check if the option you chose is still right for you.

Our short video will help you find out more about investing.

Which funds should you invest in?

There are three different options:

| Do it for me - default option |

|

Your money is automatically moved to less risky funds as you approach your chosen retirement point (your Target Retirement Age). This is known as ‘lifestyling’. Your money is invested in this option if you don’t make a choice, but you can change this any time by logging into your Pension Account. Movement between the funds happens monthly, over a fixed period. This option assumes that you will draw an income from the SEI Master Trust initially, rather than take cash or buy an annuity (a secure income for life). Most members are in this default investment strategy - it's carefully thought out and works well for a lot of people. However, you should regularly log in and making sure it still suits your personal circumstances. |

| Help me do it - other lifestyling options |

|

If you want to buy an annuity or take your money as cash, we offer two alternative lifestyling investment strategies designed to suit these options. Annuity option An Annuity is a regular lifetime income from an insurance company. There are several different types of annuity, so you should shop around to find the one that suits you. Cash option You can choose to take the whole of your Pension Account as a cash sum; 25% of it will be paid tax-free, and the rest taxed as income. |

| Let me do it - choosing your own investments |

|

Choose from a range of individual funds that cover different risk levels, asset classes and geographies. You can invest in as many funds as you want, and there is no fee for switching between funds. Some funds have higher charges than others depending on how they are managed and what assets they invest in. You’ll need to keep an eye on your investments as you get closer to retirement, as they won’t change automatically. This option is only suitable if you are confident about investments, and your goals for retirement. For more information on these different options, please log in to your Pension Account and have a look at your investment guide. |

What do you need to think about?

- All investments involve risk; taking on more risk doesn’t guarantee a better return. Click here for more information about risk.

- If you’re in a lifestyling option, remember to keep your Target Retirement Age up to date as this determines when your money moves between funds.

- If you need advice, you can find regulated financial adviser using MoneyHelper.

Want to make a switch?

Log in to your Pension Account and head to the investments section, or download a form, or contact XPS. Investment switches can take 6 or 7 working days to process.